Why Traditional Investment Advice Doesn’t Work (And What To Do Instead)

The evidence is clear: Traditional investment advice falls short of expectations. The cookie-cutter investment approach, typically investing in 60% stocks and 40% bonds, will more than likely fall short of expectations.

This post will discuss:

- Why traditional investment advice doesn’t work: The typical 60/40 portfolio falls short of expectations.

- The negative impact of drawdowns on portfolios and the often overlooked sequence-of-returns risk.

- Investment moves to make now to meet expectations and reach your retirement goals.

Traditional investment advice doesn’t work

Most investors mindlessly follow conventional wisdom or herd mentality, while some seek the guidance of a financial “professional.” Financial advisors often work for securities brokerages, banks, insurance companies, and accounting firms. While they may claim to prioritize their clients’ interests, their primary responsibility is to generate profits for their employer. Many advisors use a cookie-cutter investment approach, typically investing in 60% stocks and 40% bonds, which may not always deliver the promised returns or meet goals due to their high correlation to the market.

The typical allocation works well in periods of growing earnings and falling interest rates. However, it falls short in times of stress due to its high correlation to the stock market. Take a look:

Morningstar provided this chart showing the performance of a typical portfolio during three recent times of stress. The chart demonstrates the high correlation of a 60/40 allocation with the U.S. equity market, which is why traditional portfolios often fall short of expectations. Why is that?

The Inevitable Drawdown.

A drawdown represents the peak-to-trough decline in the value of an investment, and its impact on portfolios can be huge. Many financial projections rely on an “average” return, and investors often plan their entire retirement based on expected returns calculated from past performance. This can be a significant mistake. Why? Most investors are not familiar with “investment math,” but they should be.

The chart above from realinvestmentadvice.com clearly represents the significant risk that most retirement investors face yet are often unprepared for. It highlights how an expected average return of 7% can quickly vanish when inevitable drawdowns occur. Due to this quirk of investment math, traditional portfolios often fall short of expectations.

The often hidden Sequence of returns risk

Sequence-of-returns risk is a significant concern in retirement planning. Sequence risk refers to the fact that the order and timing of poor investment returns can significantly impact the longevity of retirement savings. The chart below from Schwab shows what happens to two investors who start with $1 million portfolios, take initial withdrawals of $50,000 (with 2% inflation adjustments each year after), but then experience a 15% drop in portfolio value. The investor who faces such a decline early in retirement runs out of money far sooner than an investor who does so later.

.

The timing and order of poor investment returns can significantly impact the longevity of your retirement savings. Simply put, the risk of the sequence of returns can either make or break your retirement nest egg.

“The first rule of an investment is don’t lose (money). And the second rule of an investment is don’t forget the first rule.” Warren Buffett

What should you do with your retirement portfolio right now?

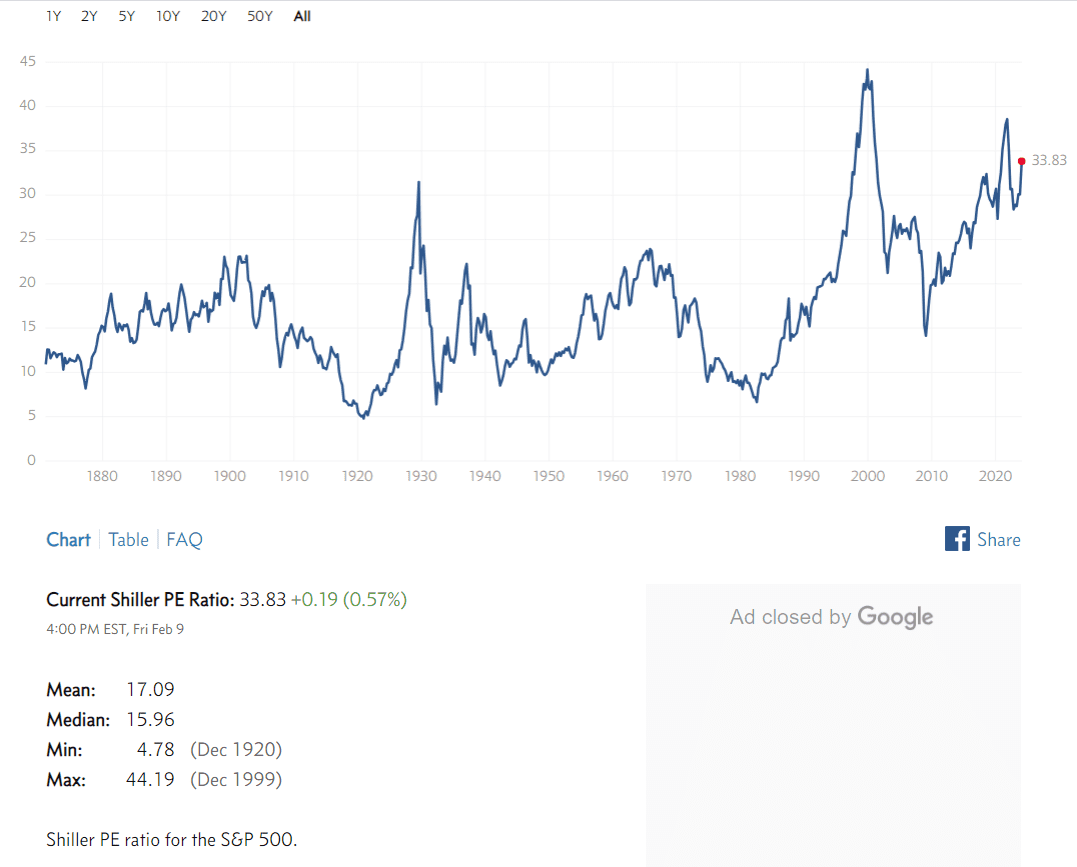

The market is currently experiencing a rally driven by several large-cap technology stocks. However, it is overvalued by historical standards and is under pressure from inflation, debt, and geopolitical tensions. The Shiller PE Ratio is a metric many use to determine whether the stock market is undervalued, fairly valued, or overvalued. The current ratio is represented in the chart below:

Historically, a lower starting valuation has been associated with much better returns over the subsequent decade. So, what should an investor do now with these different types of risks at the top of mind?

Make these investment moves now:

- Run a correlation analysis to measure the extent of your exposure to the market.

- Put together a written Investment Plan for you or a fee-only advisor to follow.

- Invest your portfolio into multiple strategies to focus on cash flow and minimize drawdowns.

We can help you put together a diversified portfolio focused on minimizing drawdowns and enhancing risk-adjusted returns. You can manage the portfolio yourself or have us manage it for you. To learn more, you can reach us here:

In conclusion:

To reach your investment goals, you should steer clear of the typical investment advice. An investment portfolio diversified into multiple strategies can help you remain invested during market turbulence. You will experience reduced downturns, attain superior risk-adjusted returns, and enjoy the retirement you deserve.

Key Takeaways:

- The typical 60/40 allocation may perform well in certain environments; however, it falls short during times of stress due to its high correlation with the stock market.

- Avoiding significant losses and avoiding sequence risk can mean the difference between financial security and running out of funds.

- Focus on cash flow and invest in multiple strategies to achieve your financial goals.

Remember, there’s no one-size-fits-all approach to investing. Do your research, carefully consider your circumstances, and consult a fee-only financial advisor before making investment decisions.