Here’s What We’re Going To Do

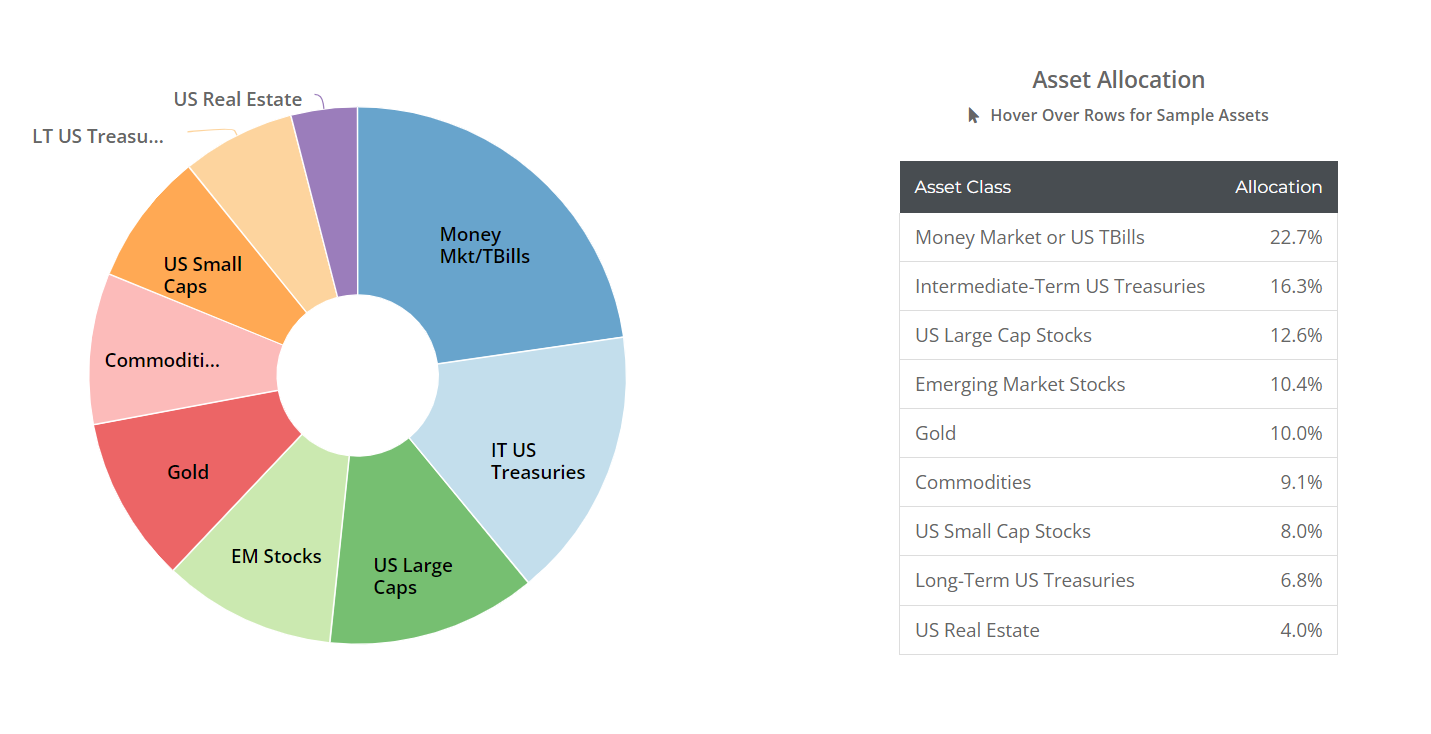

You need a clearly defined, transparent, and easy-to-follow plan. Three Streams Financial will help you build portfolios focusing on diversification, simplicity, and tax efficiency. You can manage the plan yourself or have us manage it for you.

Our Investing Strategy

Compound Returns Matter Most!

If you lose 10%, you will need an 11% return to break even. Similarly, if you lose 25%, you will need a 33% return to get back to where you started. This forces most people to take on more risk to recover their losses. However, a less volatile investment strategy, even with a lower average return, can lead to higher compound returns over time.

Direct Indexing With Dividend Growth Stocks

Buffer Funds to Control Downside Risk

Multiple Strategies to Enhance Diversification

Our Services

Our investment services are designed to help you create a diversified and tax-efficient portfolio that generates income for life. Choose Your Level of Service.

Sometimes, it's helpful to have someone review your current plan, offer advice, and ensure you're on track to meet your retirement goals.

- Analysis of your current portfolio - How much risk are you taking?

- Project your retirement withdrawal plan - Will you run out of money?

- Identify solutions you can take immediately to enhance your portfolio.

You want a comprehensive overview of your financial goals and a written investment plan to help you achieve them.

We’ll design an investment plan together, and then I’ll execute the trades and manage your portfolio for you.

Help Ensure Your Child or Grandchild's Financial Future

ADDITIONAL SERVICES

LET'S CONNECT

If you have any questions or concerns, or if you would like to work with me, email me directly at: [email protected]