The Power Of Dividend Growth Investing: Achieve Financial Freedom!

The evidence is clear: Dividend Growth Investing can be a powerful investment strategy. The longer you integrate it into your portfolio, the more likely it is to compound exponentially and provide you with lifetime income.

This post will discuss:

- What Is Dividend Growth Investing?

- The Powerful Compounding Effect of Dividend Growth.

- How To Achieve Financial Freedom With A Dividend Growth Portfolio.

What Is Dividend Growth Investing (DGI)?

Dividend growth investing is a strategy in which you invest in the shares of companies with a consistent record of paying regular and increasing dividends. This approach involves reinvesting the dividends received back into the company’s shares or shares of other companies with a similar dividend track record.

Let me give you an example:

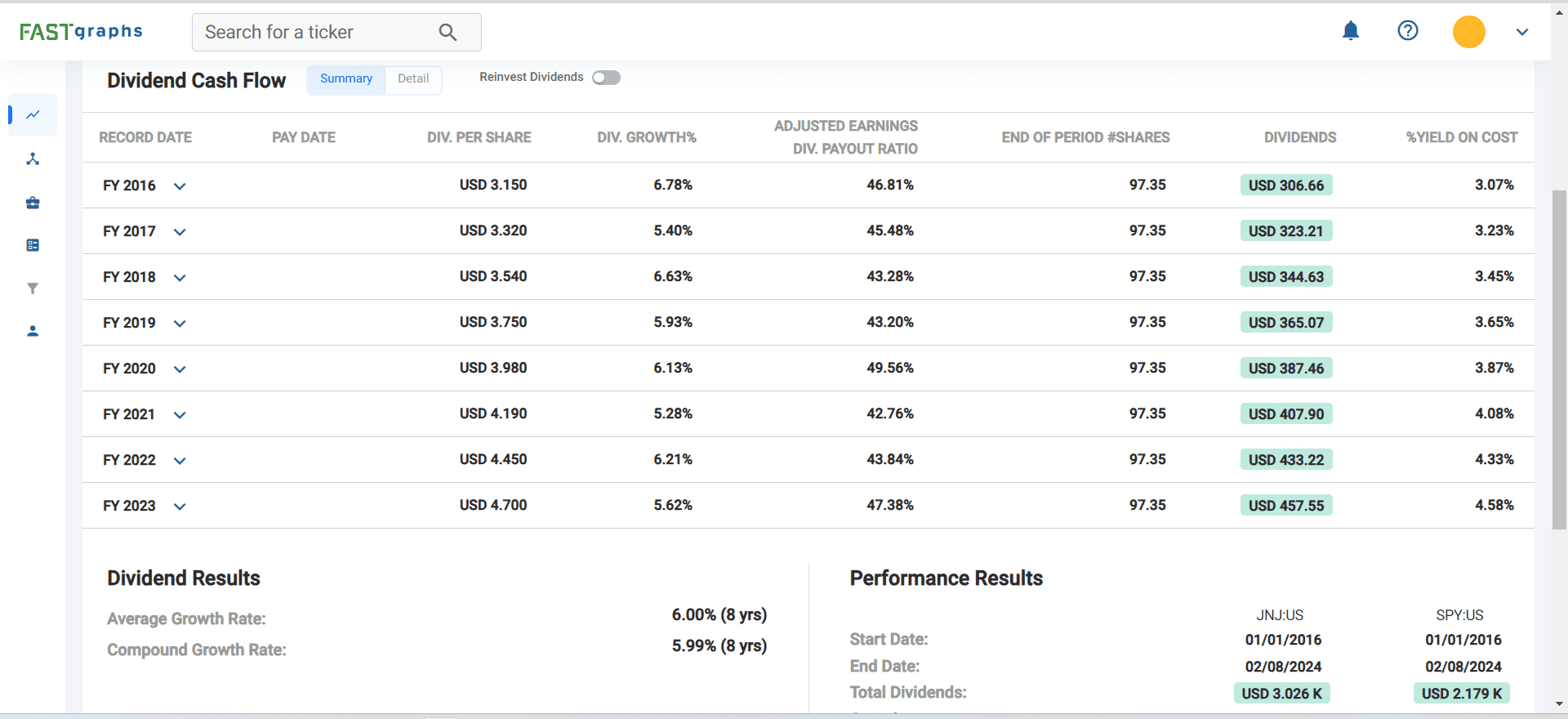

The table above from Fastgraphs.com depicts the recent dividend history of Johnson & Johnson stock (JNJ). You can see that the dividend paid per share has steadily increased every year, from $3.15 in 2016 to $4.70 in 2023, as shown in the second column. The third column displays the year-on-year percentage growth rate (6.78% in 2016). The dividend has a compound growth rate of 6% over the last eight years, as shown under Dividend Results. Moreover, JNJ has increased its dividend each year for over six decades!

The Powerful Compounding Effect Of Dividend Growth

Dividend growth investing is a strategy that combines the benefits of:

- Compounding dividends

- Compounding the growth of dividends per share

- The Increasing value of shares themselves

Imagine you earn a dividend of $1 on a stock you own. If you reinvest that $1 dividend and it also earns a return, you’re earning a return not just on your original investment but also on the accumulated dividends.

The key to success is to take advantage of the power of exponential growth by using the cash received from dividend payments to purchase additional shares in the company(ies). These additional shares will, in turn, pay out dividends in the future, creating a cycle of growth and compounding.

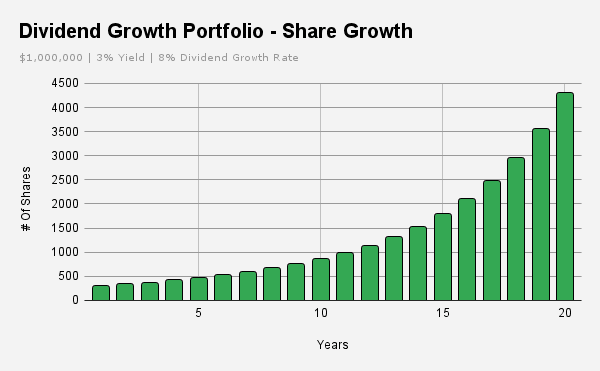

Over time, this snowball effect can significantly grow your investment. Here is the simple math: Let’s say you invest $10,000 in a company with a 3% initial dividend yield. If the company increases its dividend by 8% each year and you reinvest the dividends over 20 years, your investment could potentially grow to over $35,000! This growth is due to the compounding effect of the increasing dividend payouts and the reinvestment of those dividends.

Achieve Financial Freedom With A Dividend Growth Portfolio

How? Let the power of compounding dividend growth do the heavy lifting. Think about a well-diversified portfolio of blue-chip stocks growing their dividends every year. Although the initial payouts may be small, over time, these reinvested payouts compound exponentially, leading to significant gains in the long run. Take a look at a couple in their 40s with a $1mm nest egg to invest:

The above chart shows the yearly dividend income that can be generated with a 3% yield, 8% dividend growth, and 8% share price appreciation over a twenty-year period. This means the couple could potentially retire with more than $200,000 in annual income without ever having to dip into their portfolio’s principal!

We can help you put together a portfolio focused on companies with a history of steadily increasing dividend payouts over time. You can manage the portfolio yourself or have us manage it for you. To learn more, you can reach us here:

In Conclusion:

By reinvesting your dividends, you can grow your portfolio exponentially over time, creating a passive income stream that can help you retire earlier and live the life you’ve always dreamed of.

Key Takeaways:

- Dividend Growth Investing focuses on companies with a history of steadily increasing their dividend payouts over time.

- These companies are typically mature, stable, and profitable, with strong cash flow.

- By reinvesting these growing dividends, you benefit from both the rising income stream and the potential capital appreciation of the stock price.

Remember, there’s no one-size-fits-all approach to investing. Do your research, carefully consider your circumstances, and consult a fee-only financial advisor before making investment decisions.