The Magic Of Dividend Growth Investing: How To Outpace Inflation And Never Run Out Of Money

You’ve probably heard investors discussing dividend stocks and may have some in your portfolio. While we understand the potential for compounding, the key question is how a dividend growth portfolio can outpace inflation and provide long-term financial security. So, let’s dive in.

This post will discuss:

- What is dividend growth investing, and how can it outpace inflation?

- How dividend growth investing can boost returns and reduce portfolio volatility.

- You can generate a passive, tax-efficient income stream by investing in dividend growth.

The significant compounding effect of dividend growth can outpace inflation.

Dividend growth investing is a straightforward strategy in which you invest in the shares of companies with a consistent record of paying regular and increasing dividends. This approach involves reinvesting the dividends received back into the company’s shares or shares of other companies with a similar dividend track record. Although the initial payouts may be small, over time, these reinvested payouts compound exponentially, leading to significant gains in the long run.

Since the 1960s, dividends from S&P 500 companies have steadily increased. This indicates that stocks could potentially provide good protection against inflation. As companies grow their earnings, they can distribute more to shareholders in the form of dividends. In essence, dividends generate a consistent income stream that acts as a hedge against inflation.

You can observe in the table from dividendgrowthinvestor.com that dividends have outpaced inflation in every decade since 1960, except for the 1970s, when dividends slightly lagged behind inflation. However, stock prices fared much worse against inflation.

Why incorporate Dividend Growth Investing into your portfolio?

Dividend growth investing can boost returns and reduce portfolio volatility. By targeting these stocks, investors aim to benefit from both the potential for capital appreciation and a steady stream of increasing dividend income. This approach can cushion the impact of market volatility and generate more consistent returns over the long term. How?

- Companies that consistently increase their dividend payments usually have strong and growing earnings. They are typically mature, stable, profitable, and have strong cash flows.

- Reinvesting these growing dividends can accelerate the growth of your investment exponentially over time through the compounding effect.

- Dividend income provides a source of passive income, which can be particularly beneficial during market downturns when stock prices may be more volatile.

The evidence is clear from this chart at Ned Davis Research: Companies that have continued to grow or initiated dividends have produced higher annualized returns and lower annualized standard deviation compared to other segments of the equity market over the long term.

Create a passive, tax-efficient income stream – Never run out of Money!

Investing in dividend growth stocks can be a great way to build a tax-efficient portfolio. Dividend growth stocks not only provide a steady stream of income, but they also offer the potential for capital appreciation. Additionally, qualified dividends from eligible stocks are taxed lower than ordinary income, making them a tax-efficient investment option. The tax rate on qualified dividends is 0%, 15%, or 20%, depending on taxable income and filing status. In fact, a married couple filing jointly would pay 0% tax on up to $94,050 (2024 tax year) of qualified dividend income. Factoring in the standard deduction of $29,200 (2024 tax year), this couple could earn a passive income of $123,250 tax-free.

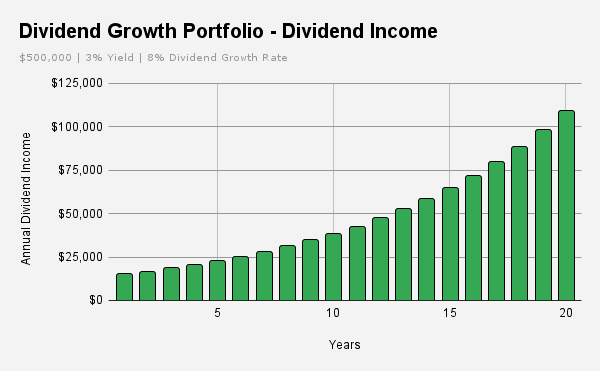

The above chart shows the yearly dividend income generated on a $500,000 portfolio with a 3% yield, 8% dividend growth, and 8% share price appreciation over twenty years. A couple filing jointly (per current tax laws) could potentially retire with more than $120,000 in annual income without ever having to dip into their portfolio’s principal!

Think about it: If you can live off dividend payments growing over time that outpace inflation, when will you run out of money?

We can help you put together a portfolio focused on companies with a history of steadily increasing their dividend payouts over time. You can manage the portfolio yourself or have us manage it for you. To learn more, you can reach us here:

In Conclusion:

Investing in a dividend growth portfolio can help to outpace inflation and provide long-term financial security. Additionally, qualified dividends may be eligible for favorable tax treatment. While dividend growth companies do not outperform in all market environments, their strong risk-adjusted returns over long periods make them an ideal core investment.

Key Takeaways:

- Since the 1960s, dividends from S&P 500 companies have consistently increased and have outpaced inflation.

- Dividend growth investing can boost returns and reduce portfolio volatility.

- Qualified dividends from eligible stocks are taxed lower than ordinary income, making them a tax-efficient investment option.

Remember, there’s no one-size-fits-all approach to investing. Do your research, carefully consider your circumstances, and consult a fee-only financial advisor before making investment decisions.