Don’t Put All Your Eggs In One Basket: The Importance Of Investing In Multiple Strategies!

The evidence is clear: Diversifying your portfolio with multiple strategies can be a powerful tool for managing risk and improving returns.

This post will discuss:

- Why does the traditional 60/40 investment strategy present a significant risk for most investors?

- How investing in multiple strategies can reduce portfolio volatility & supercharge returns.

- What might a well-diversified portfolio look like?

Don’t Put All Your Eggs In One Basket!

Most retirement investors usually have a portfolio of stocks and bonds in varying percentages. The most common allocation is approximately 60/40. The problem is that this asset allocation is too highly correlated to the stock market. Correlation is a statistical term describing the degree to which two variables move with each other.

Take a look:

The chart above depicts a standard asset allocation (portfolio 1) and a benchmark 60/40 allocation. Upon a quick glance, one can observe that both portfolios are highly correlated, with a performance summary indicating a correlation of nearly 100% (both greater than .95). Additionally, other metrics suggest a high degree of similarity between the two portfolios. While this may not be an issue when the market is on the rise, it is essential to note that most asset classes tend to move in tandem during a downturn, leading to a decline across the board (as demonstrated below).

Of course, Predicting the market’s future is impossible. Would you want to risk your life savings on a coin flip?

The Benefits Of Investing In Multiple Strategies

Is it worth the effort to create a well-diversified investment portfolio? Absolutely! While it may require more work than a typical 60/40 allocation, diversification can help you manage risk, stay invested during market downturns, and boost your returns. For instance, implementing an active strategy like dual momentum can further enhance your portfolio’s performance. Take a look below:

Did you notice the significant decrease in correlation? The tactical strategy has a correlation of 0.58, compared to the 60/40 benchmark, which has a correlation of 0.99. This lower correlation is a critical factor that contributes to better performance metrics for the tactical strategy, such as lower risk as represented by the standard deviation (7.32% vs. 10.56%), less than half the maximum drawdown over this period, higher returns (CAGR), and better risk-adjusted returns measured by the Sharpe ratio. Choosing the right combination of strategies and allocation can lead to vastly superior risk-adjusted returns.

What A Well-Diversified Portfolio Could Look Like.

We need a more diversified portfolio than the standard 60/40 allocation. Choosing a few strategies that are less correlated to the overall market and each other is vital. Here are a few ideas that we incorporate into our portfolios at Three Streams Financial:

- Consider prioritizing cash flow by investing in dividend growth stocks rather than solely focusing on total return.

- Blend your 60/40 passive allocation with other proven passive strategies less correlated to the overall market.

- To decrease overall correlation (and stay invested in the same asset classes), consider incorporating tactical strategies such as momentum, trend following, or reversion to the mean.

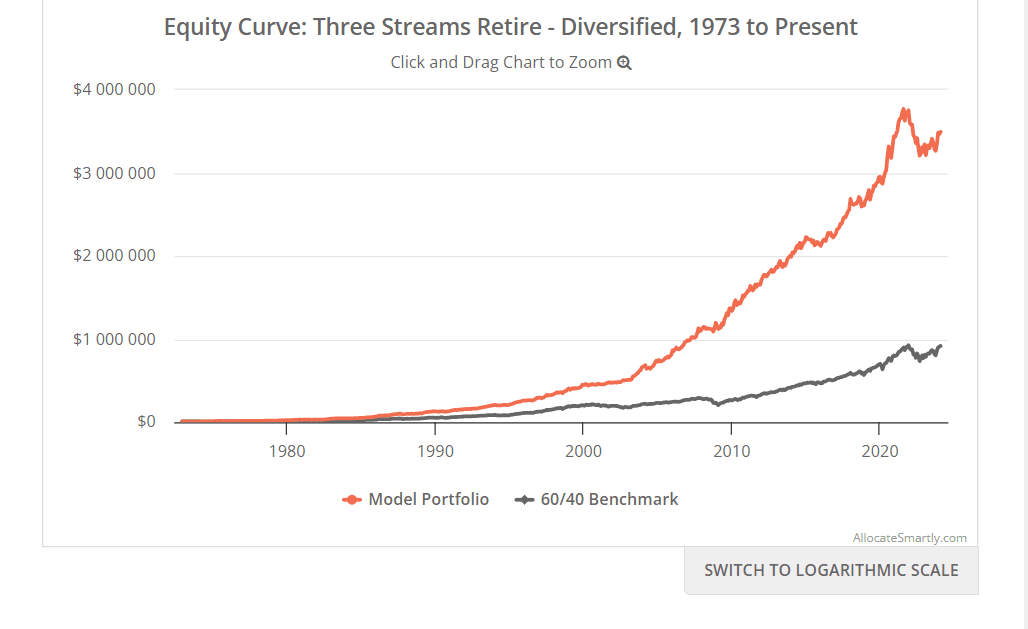

So, picture a portfolio that looks more like this:

Imagine a portfolio of multiple investment strategies consistently performing well over many years. Would you prefer a diversified portfolio or to take a chance with a single 60/40 portfolio instead?

We can help you put together a portfolio focused on companies with a history of steadily increasing their dividend payouts over time. You can manage the portfolio yourself or have us manage it for you. To learn more, you can reach us here:

In Conclusion:

It is essential to diversify your portfolio by choosing multiple strategies that are less correlated to the overall market and each other to achieve the financial retirement you deserve instead of relying on the standard 60/40 allocation.

Key Takeaways:

- Your 60/40 investment portfolio may need to be more diverse and less tied to the stock market.

- A well-diversified investment portfolio can help you remain invested during market turbulence and achieve better risk-adjusted returns.

- A diversified portfolio of multiple strategies can help you achieve the retirement of your dreams!

Remember, there’s no one-size-fits-all approach to investing. Do your research, carefully consider your circumstances, and consult a fee-only financial advisor before making investment decisions.