Feel Behind In Your Retirement Savings? 3 Steps To Take Now.

You’re not alone if you think you need to save more for retirement. A recent Bankrate survey indicates that 56% of currently employed Americans believe they must save more for retirement. I’ve been there myself, so I understand the feeling. Here are some steps you can take to get back on track:

This post will discuss:

- The significance of avoiding drawdowns to minimize sequence of returns risk.

- Focus on generating cash flow through Dividend Growth Investing.

- Take advantage of catch-up contributions available for workers aged 50 years and over, and develop a tax-efficient retirement withdrawal strategy.

Step 1: The significance of avoiding drawdowns to minimize sequence of returns risk

Feeling behind in your retirement savings is common, but there is always time to take action. While the thought of running out of money can be overwhelming, avoiding taking excessive risks to catch up is essential, especially now with markets near all-time highs and overvalued by most measurements.

Remember this: The timing and order of poor investment returns can significantly impact the longevity of your retirement savings and your ability to catch up. To mitigate sequence of returns risk, it’s imperative to be proactive and avoid large drawdowns in investment value. How?

- Find out how correlated your current retirement portfolio is to the market. Do you have significant exposure if the market tumbles from here?

- Diversify your investments across various strategies, incorporating both passive and active styles, to reduce volatility.

- Utilize Buffer ETFs to better control risk and avoid the worst of market drawdowns.

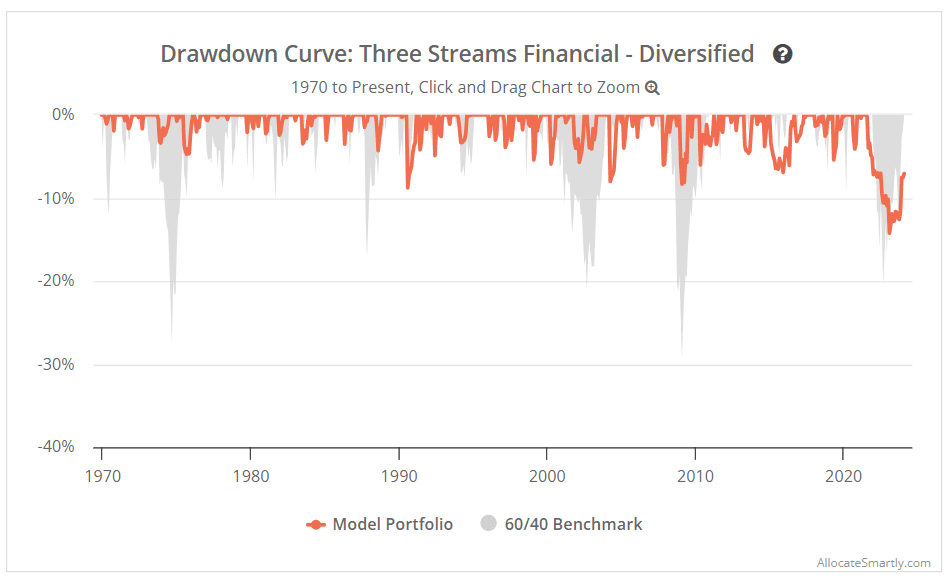

The example below shows how a properly diversified portfolio invested in multiple strategies can significantly reduce drawdowns over time compared to the standard 60/40 portfolio allocation.

By “losing less” during times when the market is most stressed, your portfolio can outperform over time. This is extremely important when you’re trying to catch up. The goal is to stay invested in the market, and you’ll be able to because your stress will be so much less. Below, you can see how the diversification benefits can lead to significantly higher account values over time.

Step 2: Focus On Generating Cash Flow through Dividend Growth Investing

Focusing on generating income for your retirement account can be a crucial and effective strategy for catching up and securing your financial future. Here are some benefits:

- Reliable income stream: In retirement, a reliable stream of dividend income from your investments can help cover your living expenses, providing peace of mind and financial security.

- Potential to hedge against inflation: Dividends or income from investments can help offset the effects of inflation by providing a rising income stream.

- Reduced reliance on Social Security: While Social Security can be a valuable source of income in retirement, you may need more to cover all your expenses. Focusing on income investments can help bridge the gap.

Sounds great, but what is dividend growth investing? It’s an investing strategy in which you invest in the shares of companies with a consistent record of paying regular and increasing dividends. This approach involves reinvesting the dividends received back into the company’s shares or shares of other companies with a similar dividend track record. Picture your portfolio invested in blue-chip stocks like IBM, Coca-Cola, Johnson & Johnson, and Costco.

Although the initial payouts may be small, over time, these reinvested payouts compound exponentially, leading to significant gains in the long run. Let the dividends compound over time to reduce or eliminate longevity risk (the risk of outliving your money). The chart below shows how your income generated from a dividend growth portfolio can grow over a 20 year period. As a bonus, according to current tax laws, you could receive tax-free income from this portfolio! You may have more or less, but picture how this additional cash flow could supplement your future social security or pension income.

Focusing on income within a diversified and well-rounded investment strategy can help you build a secure and comfortable retirement.

Step 3: Take advantage of catch-up contributions available for workers aged 50 years and over

In addition to the investing strategies above, retirement investors should take advantage of tax-friendly investment options and catch-up provisions. These provisions allow older workers to set aside more earnings for retirement. Retirement investors can also optimize social security distributions and adjust account withdrawals based on market conditions.

- Catch-up provisions allow workers aged 50 and older to save more for retirement. In many cases, investors can make additional contributions to retirement accounts such as IRAs, Roth IRAs, and 401k plans.

- Consider delaying social security until age 70 if you can stomach working a little longer or have other savings you can live off of. Delaying has multiple benefits, including higher benefits, potential tax savings, and some inflation protection.

- Adopt a flexible spending approach that adjusts retirement plan withdrawals based on market conditions. For example, withdraw less during downturns and increase withdrawals during upswings.

Of course, one of the most important things all workers should do is optimize their retirement withdrawal plan. A tax-efficient spending strategy from your retirement portfolios can absolutely make the difference between running out of money or living your retirement dream. The chart below from Kitces visually illustrates how a well-thought-out spending plan can significantly impact your financial retirement.

You may being starting off with less in your nest-egg, but the point is that how you take money out of your retirement accounts can have a huge impact on how long it lasts.

We can help you put together a portfolio focused on minimizing drawdowns and enhancing risk-adjusted returns. We’ll also craft a written retirement withdrawal strategy to help you get the most out of what you have. You can manage the portfolio yourself or have us manage it for you. To learn more, you can reach us here:

In Conclusion:

Feeling behind in your retirement savings can be overwhelming, but there are steps you can take now. The worst thing you can do is take more risk by chasing higher returns. Focus on increasing diversification to reduce drawdowns, invest more into dividend growth stocks to increase cash flow, and take advantage of catch-up contributions as you get closer to retirement. By making these smart moves, you can generate enough additional income to supplement your social security and live the retirement you deserve!

Key Takeaways:

- To mitigate sequence of returns risk, it’s important to be proactive and avoid large drawdowns in investment value.

- Generating additonal income from dividend growth stocks can supplement your social security potentially without dipping into your principal.

- Take advantage of catch-up contributions and have a well thought out, tax-efficient retirement account withdrawal plan.

Remember, there’s no one-size-fits-all approach to investing. Do your research, carefully consider your circumstances, and consult a fee-only financial advisor before making investment decisions.